30+ How much mortgage could we get

Four weeks ago the rate was 563 percent. A year ago the benchmark 30-year fixed-rate mortgage was 303 percent.

Clear To Close Mortgage Loan Officer Mortgage Shirt Lender Shirt Mortgage Lender Gift Loan Officer Gift In 2022 Realtor Shirt Mortgage Loan Officer Loan Officer

Most UK lenders consider 20 to 30 a low-risk range.

. We calculate the mortgage qualification ranges using the following maths. If you get a 30-year mortgage and you make a 20 down payment of 40000 youll have a 160000 mortgage. We take a look at the impact future rate rises could have on mortgages and the property market.

The 30-year fixed-rate average for this week is 309 percentage points higher. Borrowers within this limit typically receive more favourable mortgage rates. Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home.

In this example lets say youre looking to take out a home loan for 200000. As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate. Find and compare 30-year mortgage rates and choose your preferred lender.

At 5 per cent monthly payments on a 250000 30-year repayment mortgage would be 1462. Alternatively if you dont have your mortgage account number to hand get an idea of what mortgages we could offer you and how much the monthly costs would be by answering a few questions. The most common mortgage term in the US.

Borrowers who could secure good mortgage deals with reasonable rates. How a 1 Difference in Your Mortgage Rate Affects How Much You Pay. This is known as a mortgage term.

Do you want to. On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more over 30 years compared to having a credit score of 760 or higher. Your Mortgage Qualification Low End.

Filters enable you to change the loan amount duration or loan type. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator. How much money could you save.

Check rates today to learn more about the latest 30-year mortgage rates. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. In fact the typical mortgage length or average lifespan of a mortgage is under 10 years.

Most people with this type of mortgage wont keep the original loan for 30 years. Poor 561 720. A 30-year mortgage gives the borrower 30 years to pay back their loan.

By default 30-yr fixed-rate loans are displayed in the table below. If you only put down 10 youll have a 180000 mortgage. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

265 One Month Money Challenge A Fun Way To Save Earn Nearly 300 Without Even Trying Money Saving Challenge Savings Challenge Money Challenge

Money Challenge How To Save 500 In 30 Days Money Challenge Budgeting Money Save Money Fast

Mortgage Lender Woes Wolf Street

Pin On Business

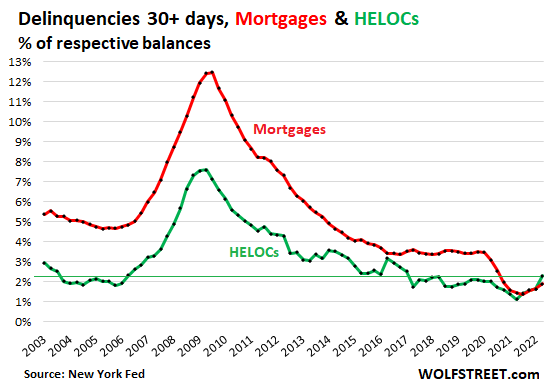

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

Buy A Duplex With Less Than 5 Percent Down Mortgage Rates Mortgage News And Strategy The Mortgage Reports Mortgage Rates Mortgage Fha Mortgage

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Loan Signing Agent Notary Signing Agent

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Pin On Loan Signing Agent

30 Maps Of America That Will Make You Question Everything You Know About The Usa Opossumsauce America Map Usa Map Question Everything

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

10 Free Printable Savings Trackers A Cultivated Nest Savings Tracker Savings Plan Tracker Free

30 Facebook Marketing Tips For New York Real Estate Professionals Estrategias De Marketing Marketing De Contenidos Blog De Marketing

Dave Ramsey S 7 Baby Steps What Are They And Will They Work For You Money Management Money Saving Strategies Money Management Advice

40 Ways To Save 500 Each Month That Actually Work Saving Money Chart Money Plan Money Saving Strategies

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage

Follow These 10 Commandments When Buying A Home Or Applying For A Mortgage And You Can Assure Yourself That Y Home Buying Real Estate Infographic Changing Jobs